By Chris Luckenbill

The importance of commercial fleets cannot be underestimated as work trucks across industries help deliver the services that keep people, organizations, and the economy moving forward. Thus, ensuring the mobile workforce make it to their destination safely and efficiently is mission critical—not only to improve productivity and job completion rates, but also to stay compliant and make roads a safer place for everyone. Unfortunately, insurance companies often see commercial fleets as a “bad risk” due to vehicle-related risks such as distracted driving, insurance fraud, near-misses, and perilous weather conditions. Thus, fleet managers need to arm their teams with the necessary training and technology to increase driver safety and lower at-fault incidents.

But how do insurance companies rate fleets for their safety risk and set premiums based on those details? The widespread assumption may be that insurance agents have a built-in set of criteria for the trucking industry that would provide some consistency: the consumer is to credit score as the fleet is to risk score, right? Well, it’s a bit more complicated than that.

The reality is that there is no uniform standard for insurers to use when rating a fleet’s risk potential to determine its premium. When financial institutions assess a consumer’s credit score to deduce the level of risk, they have clear boxes to check—they take a person’s data and evaluate it. However, when it comes to determining a fleet’s risk score, there is no standardized scale, leaving fleet managers with no concrete insight into how underwriters assess their level of risk. So, to control how insurers rate them, fleet managers should make a concerted effort to invest in enhanced safety technology and training for drivers and incorporate video telematics to safeguard their fleet’s reputation and survival.

USE YOUR DATA

Insurance companies assess risk for fleets by determining a loss rating to establish the premium needed to cover predicted losses based on previous performance and claims. They then factor in discretionary pricing based on the underwriter’s individual perception of the risk level for the industry and their evaluation of the fleet’s training programs and driver performance. A critical factor also taken into consideration is preventive measures fleet managers use to offset risk, such as telematics. It is important to note that conventional telematics is no longer the answer to risk management. Many fleets look to video telematics, like smart dashcams, to track driver behavior and the behavior of other drivers on the road, which can save a fleet millions of dollars in fraudulent lawsuits and insurance scams.

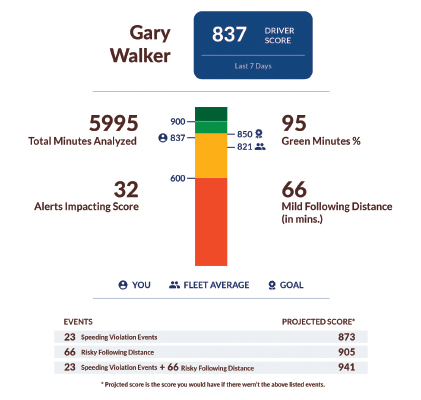

Fleet managers should expect to spend at least two years working on driver training and using video telematics to supply underwriters with evidence to make their case for lower premiums. While it can be a hassle to work on this process for an extended period, it is time well spent when the reward is enhanced driver safety and reduced cost of claims and unexpected business disruptions. Using scorecard data to showcase a two-year improvement shows the fleet’s level of commitment to safety and sustained commitment to lowering incidents. Video telematics data provides evidence of improved driver behavior, and it helps prevent accidents. Below are some additional ways video telematics and other advanced technology help steer fleets from being considered high-risk to low-risk investments:

Smart Dashcams

Smart dashcams allow fleet managers to manage driver behavior and automatically coach improvements that need to be made. Some examples of this include distracted driving and unsafe following distance. Some cameras have audio in-vehicle alerts to help drivers correct their behavior alongside virtual coaching apps to help them address unsafe habits. Some insurance companies offer discounts to fleets that use smart dashcams. Dashcams provide critical evidence to prevent liability in accidents in which other drivers intentionally or unintentionally caused the crash and tried to commit insurance fraud by saying it was the work truck driver’s fault.

Video Telematics Data

Data from video telematics puts isolated incidents into perspective. For example, the work truck’s technology may have reported that the driver made a sudden and unsafe turn. The context here was that the driver in front of them slammed on their breaks to avoid hitting a deer. This is an example of an isolated incident in which the driver was not at fault, and it was a necessary shift in their driving.

GPS Tracking

This technology alerts and reports on hard breaking, hard acceleration, and swerving behaviors to reduce severe incidents. A two-year study of 26 fleets showed that monitoring these inertial based driving events alone can lower at-fault claims by 30%.

Real-time Incident Detection

Incorporating a real-time incident detection solution does the time-consuming work for fleet managers by handling the review of dashcam footage and using artificial intelligence to monitor driving behaviors without the need for human intervention.

DATA INTO ACTION

It’s not enough to simply have telematics—insurance companies need proof that fleet managers are also using the insight provided by the technology to institute new training programs for drivers to rectify any recurring issues. The most effective way to ensure lowered premiums is for fleets to partner with their telematics provider and put the data into action. In a consistently changing world, the one aspect of commercial fleet management that should always be constant is the focus on safety.

ABOUT THE AUTHOR

Chris Luckenbill is the marketing director for GPS Insight, which provides organizations across North America with best-in-breed telematics, video telematics, and field service management technology. Find out more, visit www.gpsinsight.com.