Financial Wellness Month is observed throughout January each year. It was created to remind people to pay closer attention to their financial wellbeing. With the continued challenges to the overall economy and companies with transportation fleets, Fleet Advantage will extend the focus of Financial Wellness Month by offering a complimentary financial analysis of fleet operations, including a lease versus purchase analysis.

As part of its Asset Management solutions, Fleet Advantage conducts a Fleet Modernization Study to directly address key operational as well as financial areas and provides recommendations for cost savings. Additionally, the study analyzes multiple data points including a fleet’s performance and use and current cost per mile (CPM). Further, the analysis factors depreciation, finance, maintenance, repair, and used truck values. Each of these areas are critical in promoting better safety, economic competitiveness, life cycle flexibility, and quality of life for drivers and also other motorists.

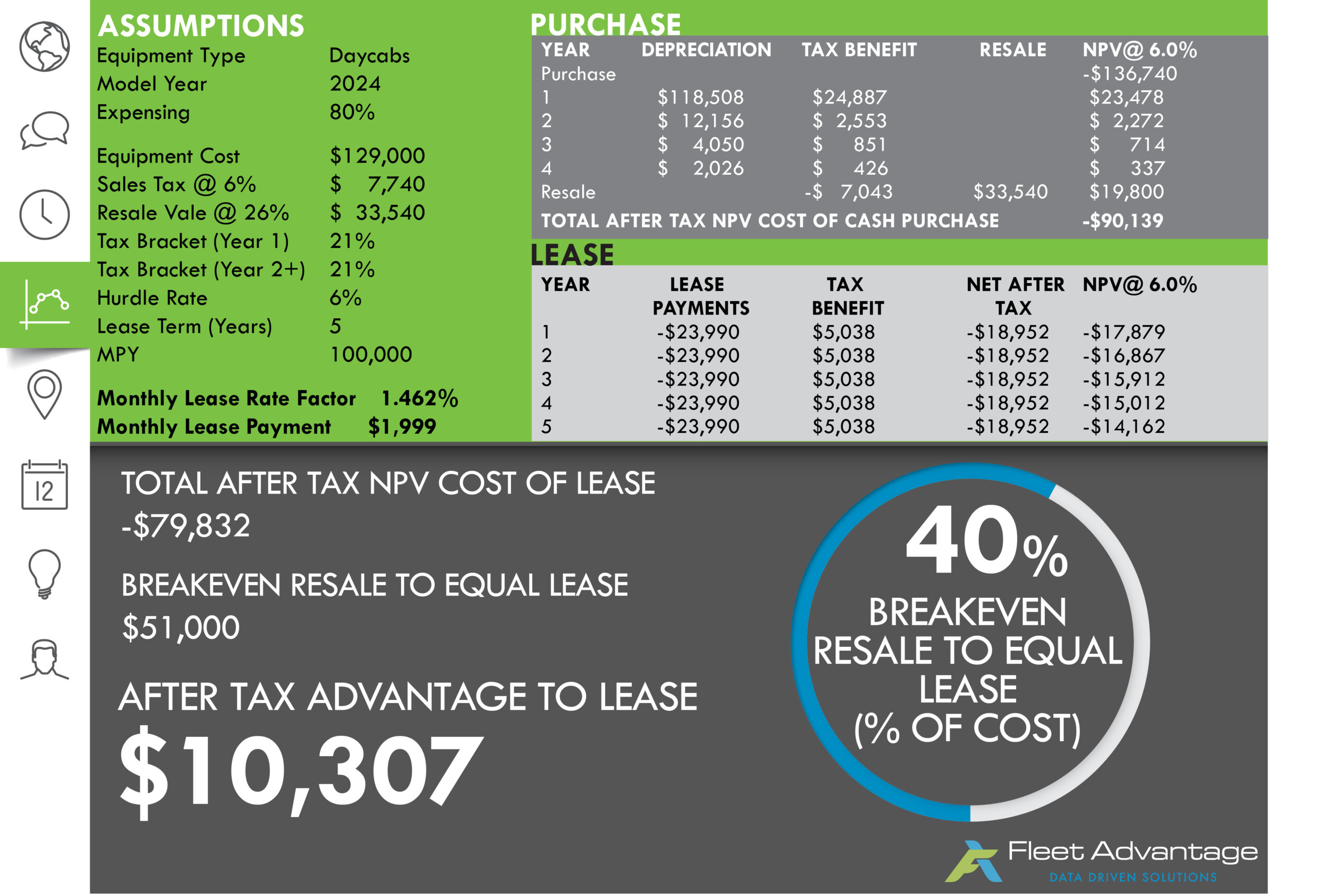

Fleet Advantage also works with organizations to review their procurement strategy and key financial metrics. The company offers detailed and thorough lease versus purchase analysis and also continuously reviews different lease structure types. This helps fleets determine whether to finance their trucks through lease programs that enable shorter trade cycles or different structures. These structures include unbundled lease versus full-service lease, which is a long-term contract with no fuel and maintenance cost flexibility. According to a recent industry benchmarking survey, nearly half of respondents (42%) are leasing trucks today. This is up from 31% a year ago. Furthermore, the government’s slight 20% reduction to bonus depreciation effective 2023 means leasing remains the most favorable option for fleets planning new equipment acquisitions.

ADDITIONAL CONSIDERATIONS

Additional financial wellness metrics to take into consideration:

- Sales tax analysis

- Comparative cost analysis to determine the optimal time to upgrade equipment

- Diesel vs EV Comparative cost analysis

- Per unit P&L

- OEM Equipment Cost Tracking

- SWAP Rates

- Residual Values

Brian Holland, Fleet Advantage president and CEO says it’s important to offer data analysis and guidance for clients’ success. He says the Fleet Advantage team dedicates itself to helping clients with strategy and planning for financial flexibility.

“Trade cycles that fleets normally operate may not currently be available, and if they are, the costs are constraining,” says Jackie Jacobs, CLFP, senior fleet transaction analyst and project manager for Fleet Advantage. “We have long believed that leasing is a proven strategy to preserve cash flow, optimize asset utilization and provide maximum financial flexibility. Our lease versus purchase analysis and data analytics resources helps fleets review the cost of their operation and find ways to navigate the current difficult climate.”

Find out more, visit www.fleetadvantage.com.