The rapid electrification of the light-duty vehicle market is being driven globally by governments that are working overtime to address climate change. Whether it’s the result of direct regulation of the vans and trucks in question or more restrictive carbon dioxide (CO2) emissions targets, original equipment manufacturers (OEMs) have responded by designing and building electrified vehicles to address the changing market.

Numbers vary by analyst, but there is a consensus that more than half of the light-duty new vehicle market will consist of hybrid electric vehicles (HEVs) and battery electric vehicles (EVs) by 2030. With so many electric vehicles coming onto the market, the light-duty truck market will not be immune to these changes. The latest e-hardware configurations will require new lubricants, often termed e-fluids, to address the challenges that arise with electrification.

Conventional lubricants designed for internal combustion engine (ICE) vehicles aren’t specifically engineered for HEV and EV vehicles, so lubricant manufacturers are working diligently to engineer fluids that are tailored to electric fleets. Like traditional fluids, e-fluids should help protect parts under a broad range of temperatures while maximizing mechanical efficiency. Unlike traditional fluids, e-fluids must be compatible with new materials of construction and more sensitive copper componentry, deliver optimal electrical conductivity, and sometimes function as the motor cooling fluid.

Lubricant manufacturers are engineering these fluids now to prepare for a future where ICE engines become less common and electric vehicles begin to dominate the market.

MARKET STATUS

Currently, most light-duty trucks and vans contain internal combustion engines. The technology is well understood, and lubricant manufacturers have decades of experience in making fluids for these vehicles. Even though the market for ICE is mature, ICE innovation continues alongside EV innovation.

But the market is changing, thanks to concerns about climate change driving some countries to ban ICE vehicles entirely from fleets within the next decade. These legislation changes are driving the trend toward battery electric vehicles. Currently, analysts predict that one-third of the light-duty vehicle market will consist of battery electric vehicles by 2030 with a second-third being hybrid electric vehicles. As the market evolves rapidly, it is both exhilarating and daunting to think of the number of emerging new e-driveline architectures and what characteristics the lubricants must have to accommodate these different configurations.

LUBRICANT EVOLUTION

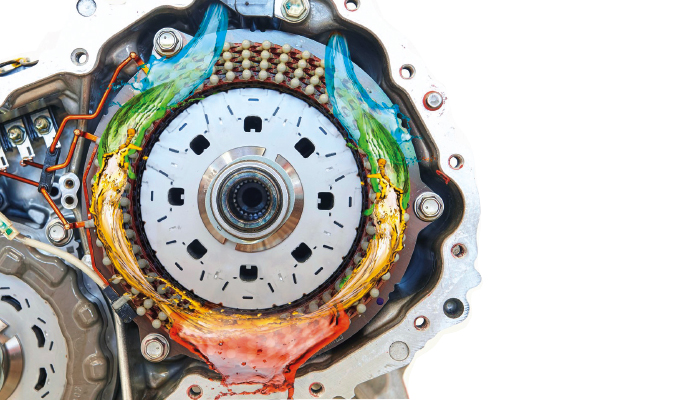

e-Driveline architectures incorporate the electric motor, inverter, and gearbox into the powertrain. As a result, the powertrain contains significantly more copper than a traditional vehicle. Many EVs contain nearly six kilometers of copper wiring in their batteries, windings, and e-motor rotors. In the latest hardware configurations, these elements can come into contact with the lubricant, therefore copper compatibility must be taken into account. Even unlubricated components above the oil line can be affected by corrosive vapors that may form as the motor runs. Corroded copper in an EV could cause electric motors to short out and fail, leaving commercial operators with expensive motor repairs or replacements.

e-Devices still incorporate plastics in the same ways that traditional devices do (e.g. nylon bearing cases), but they also contain new materials of construction that must be compatible with the lubricant. These materials can be used in components such as wire coatings, lamination coatings, circuit boards, and insulating papers and are often polymers derived from silicon, acrylates, amides, imides, sulfides, or ethers. It is critical that the lubricant does not degrade the integrity of these materials. Additionally, e-fluids are designed to be more stable to oxidation and thermal breakdown as they must be able to stand up to potential high temperature excursions in the electric motors. Upon exposure to high temperatures, lubricants can degrade over time resulting in deposits and sludge that can harm components and vehicle operation.

Unlike with their predecessors, electrical conductivity of e-fluids is an important concern. If the conductivity is too low, it can lead to static discharge that can cause pitting on the components. Conductivity that is too high on the other hand, can lead to current leakage, lower efficiency, and potential shock hazards. Viscosity and additive chemistry play large roles in keeping conductivity within its proper parameters.

THERMAL PROPERTIES

e-Fluids are designed to keep devices cooler, which keeps the motor operating at peak performance and extends the range available to the vehicle. The thermal properties of lubricants are an important factor in their performance these days, and engineers pay more attention now to the fluid’s thermal conductivity and heat capacity, as well as fluid density and viscosity profiles as they relate to heat transfer.

Practically speaking, many lubricant manufacturers are reducing viscosity to enhance the lubricant’s thermal properties and improve its heat transfer capability. Lowering viscosity can also improve mechanical efficiency depending on the duty cycle—but that approach brings its own challenge. Thinner fluids have a risk of foaming or exhibiting aeration, and they typically have higher electrical conductivity, which is undesirable. Furthermore, the thinner fluid films associated with low viscosity fluids make it more difficult to protect parts like gears and bearings. Balancing these competing goals is one of the biggest challenges manufacturers face as they try to engineer e-fluids for light-duty trucks and vans.

A Changing Industry

As the electrification of light-duty vehicles continues with increasing speed, fleet owners are going to have to change their thinking about what lubricants are appropriate to use in electric vehicles. No longer will traditional lubricants suffice to protect all of the proliferating types of vehicle hardware. Instead, specific e-fluids will be required to maintain the long-term protection of the drivetrain while avoiding damage to the wiring, optimizing electrical conductivity and improving efficiency.

Lubricant manufacturers have a vital role to play in formulating their lubricants to meet and exceed the requirements for the latest generation of EVs. The partnership between OEMs, additive companies, and lubricant manufacturers is critical to understanding the specific fluid requirements and formulating e-fluids to ensure hardware is protected in new EVs.

ABOUT THE AUTHORS

Amanda Eastwood is a product manager for Driveline Additives, based in Hazelwood, UK, with global responsibility for electrified driveline product lines. Prior to joining Lubrizol, Eastwood worked in the European chemical industry in a variety of commercial and technical roles, both in Germany and the UK. In the last 15 years, Eastwood’s focus has been in the lubricant and metalworking industry.

Suzanne Patterson is a technology manager for Driveline Additives, located in the United States, with global responsibility for axle and electrified vehicle fluid platform development and product support. Patterson has been with The Lubrizol Corporation for 17 years working in the chemical synthesis of viscosity modifiers and small molecules before moving to Driveline. Find out more, visit www.lubrizol.com.