Fleet managers and contractors have a lot on their mind at any given moment of the day. Aside from the job at hand—be it overseeing a construction project, receiving customer calls, training new employees, or planning jobs for the next season—fleet managers must ensure their drivers are safe, efficient, and yes, even spending company money ethically and intelligently. U.S. Bank developed a new fleet card that offers solutions for fleet managers and operators to simplify fleet spending and allow focus to be shifted where it’s most needed.

WHAT ARE REASONS A FLEET MANAGER WOULD PREFER A CARD SPECIFICALLY FOR FLEET-RELATED EXPENSES VERSUS A REGULAR COMPANY CREDIT CARD?

JEFF PAPE, U.S. Bank: Managing fleet expenses and payments can be a major challenge—at least without the right solutions. Standard commercial cards were not designed with the complexities of fleet expenses in mind and are just not set up to help fleets operate efficiently. Put simply, two of the most critical needs a fleet manager requires to be effective in a highly specialized industry are purchase controls and data visibility. There’s no denying that commercial cards provide both, but not anywhere near the level—and type—of detail that fleet managers require.

For example, being able to set spend controls and profiles at the individual driver or vehicle level would be challenging, if not improbable, on a standard commercial card. From a data perspective, the ability to export transactional data leveraging APIs (application programming interfaces) to flow through a company’s telematics systems, as well as its ERP (enterprise resource planning), is critical to ensuring that the company has real-time information to make informed decisions.

Working with our customers for nearly a quarter century, we’ve collaborated to design and implement these control and data capabilities. More than a third of our U.S. Bank Global Transportation team members have at least 10 years of experience in related industries like oil and gas, convenience stores, truck stops, and fleet operations. Our customer service personnel average more than five years of experience and are recognized yearly for the quality of service they provide. Unlike a standard commercial card, a fleet card program was designed specifically to create efficiencies for fleets and to allow drivers to focus on the important job they have transporting goods.

WHAT’S ON THE HORIZON FOR U.S. Bank WHEN IT COMES TO OTHER NEW PRODUCTS AND FEATURES FOR ITS FLEET PROGRAM?

PAPE: Much of our product roadmap for this year and next is tied to four strategic priorities: Creating an engaging user experience, continuous improvement, introducing new capabilities, and growth.

I would like to highlight a partnership that we will pilot soon providing tokenization for purchases. Tokenization replaces the PAN with an alphanumeric key that contains no sensitive data and no exploitable value during a transaction. This will provide three primary customer benefits: reduce payment risks by eliminating the need to manage/store a PAN, enhance the user experience, and increase transaction security.

We’ve also identified additional use cases for cardless payments, which include connected vehicle scenarios using radio-frequency identification (RFID) or near field communications (NFC) technology—allowing two NFC-enabled devices to communicate within close proximity of each other—for use at truck scales, to pay tolls, to charge an electric vehicle, etc. We are excited about a pilot in the first quarter of 2022.

U.S. Bank CURRENTLY OFFERS THE U.S. Bank VOYAGER FLEET CARD. WHAT MAKES THE VOYAGER MASTERCARD A BETTER OPTION FOR FLEETS?

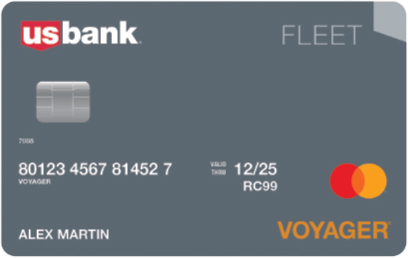

PAPE: We don’t see one of our fleet card offerings as being a better option for clients than the other, but rather a product offering based on their needs and objectives. We’ve worked closely with the fleet industry for several decades offering the Voyager Fleet Card, and the U.S. Bank Voyager Mastercard is our first dual network fleet card. Having access to both networks is really important to many fleets. This includes the Voyager network, which we own and operate with more than 320,000 retail, truck stops, and maintenance provider locations across the United States. The addition of the Mastercard network allows drivers to pay for essential fleet-related items—outside of fuel and maintenance—such as emergency travel purchases including unexpected tows and repairs, overnight stays and food, toll road fees, and parking, as examples. The U.S. Bank Voyager Mastercard allows for purchasing fuel in remote areas, cross-border in Canada and Mexico or internationally, and gives fleet managers and drivers added benefits and peace of mind that they’re covered on the road and beyond.

HOW CAN FLEET MANAGERS/OWNERS REMAIN IN CONTROL WITH FLEET DRIVER SPENDING WITH THE VOYAGER MASTERCARD?

PAPE: Our new Voyager Mastercard allows fleet managers the ability to tailor spend controls, be it for individual drivers and/or vehicles, while retaining full visibility and oversight across the expanded purchase categories with enhanced travel benefits. From everyday fuel and maintenance purchases to unexpected situations such as inclement weather, road construction, or emergency repairs, fleet managers will now have increased flexibility to manage all fleet-related expenses with ease. Plus, the Voyager Mastercard streamlines program management. Those same fleet managers will see all Voyager and Mastercard transactions within Fleet Commander Online, our program management portal, eliminating the need to rely on a second fleet program administration tool, saving them time and money.

WHAT KIND OF FLEET BENEFITS THE MOST FROM THE VOYAGER MASTERCARD?

PAPE: With broad acceptance on both Voyager and Mastercard, this new payment solution supports fleets of all sizes and classes. However, it is very well suited for mixed fleets. The U.S. Bank Voyager Mastercard enhances driver efficiency and reduces costs while supporting data integrity and preventing fraud and misuse.

The card differs in its simplicity and security. It is simple because it’s a convenient, single card for drivers to use and a single platform for fleet managers to manage their program. It’s secure because the dual network is supported via the encrypted EMV chip—versus a magnetic stripe—and backed by a heavily regulated financial institution with an unparalleled history in the fleet industry.

ADDITIONAL THOUGHTS?

PAPE: Innovation is driving everything we do. If we’re not innovating for our customers, we’re falling behind. As previously highlighted, the U.S. Bank Voyager Mastercard co-brand is an innovation that allows us to expand into Canada, Mexico, and internationally to support our customers’ broader needs.

APIs are another example of how we’re innovating. Voyager’s original API was created to provide an efficient way to securely share data with our fleet customers and partners. APIs are rapidly being adopted and have taken a more critical role as the ability to share data is paramount to address evolving market needs and real-time data requirements. Originally launched in 2019, our Transaction API provided fleet customers and partners with access to Voyager transaction data in real time.

Jump ahead to 2021 and our intent is to deliver a full catalog of account management APIs, differentiating us from competitors with partial or no APIs in their service offerings. We see opportunities for real-time alerts on fuel prices as well as APIs for fleets and third parties to integrate vehicle telemetry data. And, with more OEMs equipping fleet vehicles with data communications capabilities, our API strategy will position us well for the emerging connected fleet market.

FOR MORE INFORMATION

Jeff Pape is the general manager for the transportation group at U.S. Bank Corporate Payment Systems. Find out more, visit https://pages.usbank.com/voyager-mastercard.